Autumn Budget 2021

The Chancellor of the Exchequer presented his Autumn Budget to Parliament on Wednesday 27th October 2021.

Setting out the government’s tax and spending plans for the year ahead, Chancellor Rishi Sunak said his plans were focused on the “post-COVID” era and would pave the way for an “economy of higher wages, higher skills, and rising productivity”.

Click here to find out the key points from the Autumn Budget.

October 2021 Update

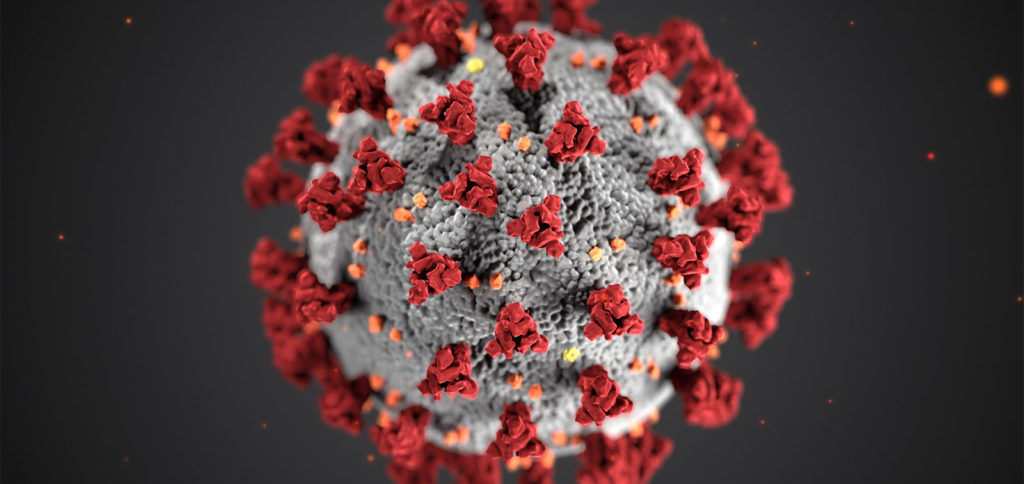

England has now moved to the final stage of easing COVID-19 restrictions.

Prime Minister Boris Johnson has urged caution as most legal restrictions on social contact have now been lifted.

There are now no limits on how many people can meet or attend events; nightclubs have now reopened; and table service will not be necessary in pubs and restaurants.

Face coverings will be recommended in some spaces, but not required by law.

July 2021 Update

England will move to the final stage of easing COVID-19 restrictions on 19th July, ministers have confirmed.

It means almost all legal restrictions on social contact will be removed.

UK Prime Minister Boris Johnson said it was vital to proceed with “caution”, warning “this pandemic is not over”.

The peak of the current wave is not expected before mid-August and could lead to between 1,000 and 2,000 hospital admissions per day, according to government scientists.

Central estimates from modellers advising the government also show that COVID-19 deaths are expected to be between 100 and 200 per day at the peak, although there is a large amount of uncertainty.

Click on the image below to find out the latest information.

March 2021 – The Budget

The Chancellor of the Exchequer presented his Budget to Parliament on Wednesday 3 March 2021.

In a Budget which ‘meets the moment’, the Chancellor has set out a £65 billion three-point plan to provide support for jobs and businesses as we emerge from the pandemic and forge a path to recovery.

The three-point plan to protect jobs and strengthen public finances includes:

- billions to support businesses and families through the pandemic

- investment-led recovery as UK emerges from lockdown

- future changes to strengthen public finances

Chancellor Rishi Sunak said his immediate priority continues to be supporting those hardest hit, with extensions to furlough, self-employed support, business grants, loans and VAT cuts – bringing total fiscal support to over £407 billion.

He also set out plans to drive jobs, growth and investment to help the economy rebound and spoke honestly about the tough choices required to put the public finances on a more sustainable path.

Click on the image below to find out more.

November 2020 Update

In light of the increased restrictions needed to curb the coronavirus pandemic, the UK government is introducing additional economic measures to support you and your employees.

Latest changes that may impact you

The Coronavirus Job Retention Scheme (CJRS), which was due to end on 31 October, will now be extended, with the UK government paying 80% of wages for the hours furloughed employees do not work, up to a cap of £2,500 for periods from 1 November.

You will need to pay all employer National Insurance Contributions (NICs) and pension contributions. You can choose to top up your furloughed employees’ wages beyond the 80% paid by the UK government for hours not worked, but you are not required to do so.

There will be no gap in support between the previously announced end date of CJRS and this extension.

For more information, go to GOV.UK and search ‘furlough scheme extended’.

October 2020: COVID-19 Accounting Implications

The coronavirus (COVID-19) pandemic has developed rapidly in 2020. Measures taken to contain the virus have affected economic activity, which in turn has implications for financial reporting. The implications include not only the measurement of assets and liabilities but also disclosure and possibly an entity’s ability to continue as a going concern.

Click here to listen to the PwC podcast series for accounting updates on COVID-19.

Overview

Moracle has been adapting to the new business environment brought upon by the ongoing coronavirus pandemic.

COVID-19 has had a significant impact on global financial markets and continues to cause unprecedented upheaval to all aspects of our lives.

Our team have been working remotely in recent months and have successfully adapted to this new working environment. We are committed to not only continuing our regular service, but also embracing the new opportunities and challenges that the coronavirus pandemic has provided.

We continue to strive towards the highest degree of professionalism and service towards all of our clients and will continue to serve their needs to the best of our ability.

This is a challenging time for us all, but our clients can be assured of our continuing support and we wish you and your family the very best throughout this testing period.